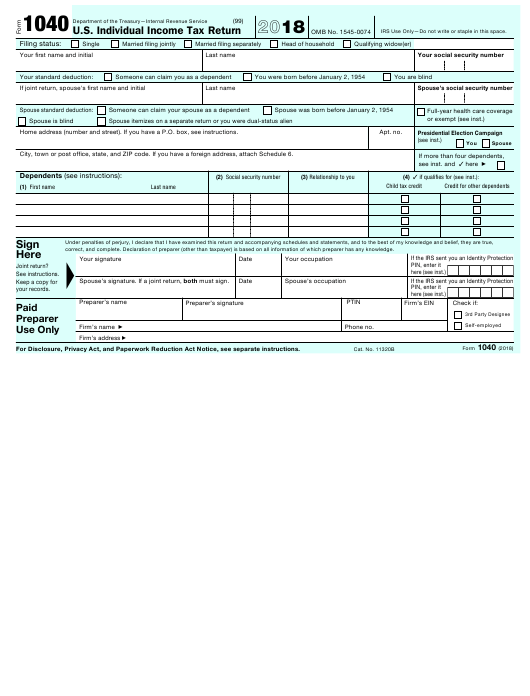

For small business owners and self-employed people, that usually means making quarterly estimated tax payments as their business earns or receives income during the year. The IRS will treat an LLC as either a corporation or a partnership, or as part of the owner's tax return (e.g., sole proprietorship), depending on elections made by the LLC and its number of members.īy law, everyone must pay taxes as they earn income.

S Corporations - Are corporations that elect to pass corporate income, losses, deductions and credits through to their shareholders for federal tax purposes.

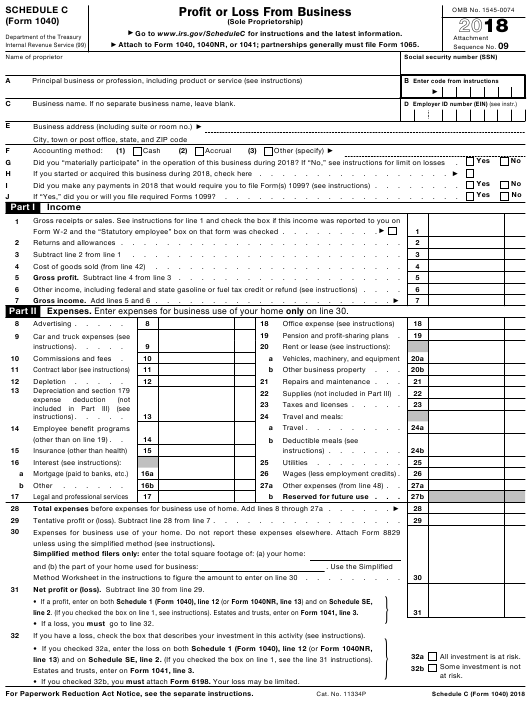

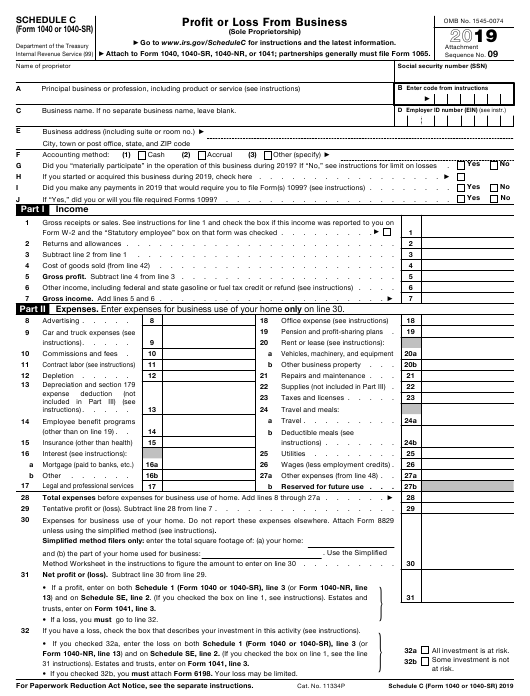

Corporations - In forming a corporation, prospective shareholders exchange money, property or both for the corporation's capital stock.Partnerships - The relationship between two or more people to do trade or business.Sole proprietorship - When an individual owns an unincorporated business by themselves.This helps determine which income tax return form must be filed. Taxpayers must decide what form of business entity to establish when starting a business. Business owners can get their EIN immediately by applying online at IRS.gov at no cost. It's a permanent number and can be used for most business needs, from opening bank accounts to filing a tax return by mail. Most business owners will need an Employer Identification Number (EIN). When choosing to start a business, it's important to consider the following: Employer Identification Number Next week, the IRS will be highlighting some of these resources, and also plans a special Twitter chat on Thursday.

To support the special week, the IRS has a variety of resources available for small business owners to help them understand and meet their tax responsibilities. National Small Business Week is an annual effort led by the Small Business Administration to recognize the hard work, ingenuity and dedication of America's small businesses and to celebrate their contributions to the economy. WASHINGTON - As part of National Small Business Week, April 30 to May 6, the Internal Revenue Service is highlighting tax benefits and resources to help those looking to start a business. IRS Small Business Self-Employed Tax Center | ASL

0 kommentar(er)

0 kommentar(er)